Thematic Investing

What is Thematic Investing?

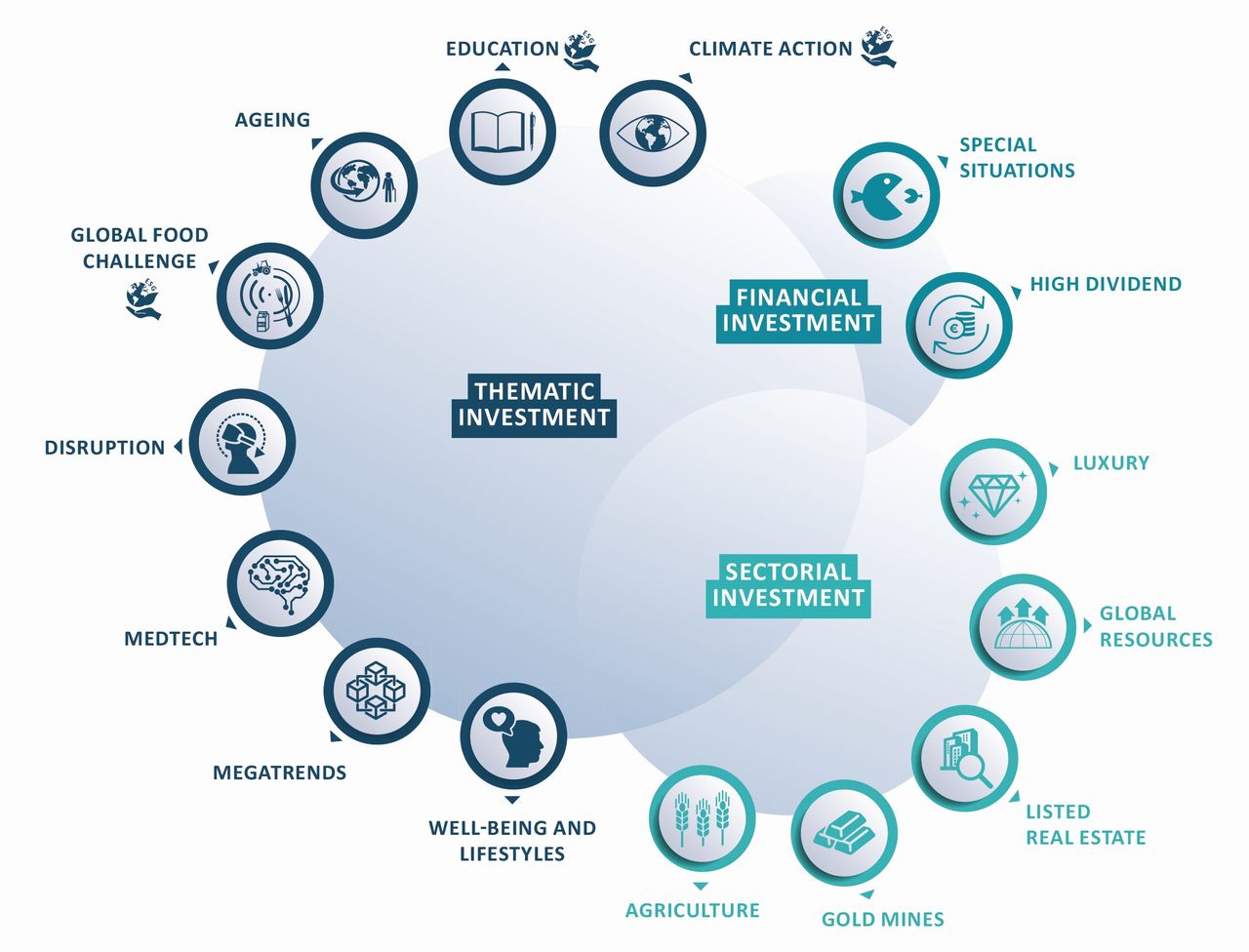

Thematic investing seeks to identify structural trends which are able to generate long-term growth, in order to provide robust and resilient investment solutions irrespective of economic conditions and events.

In a context of market turmoil, thematic investing stands out as an alternative to cyclical hazards. The Equity market has been polarizing between passive strategies (index funds and ETFs) and higher conviction active strategies. Deviating from a constraining reference index, thematic funds are gaining ground as core holdings within a portfolio by bringing extra alpha.

Investment Opportunities

Why Thematic Investing?

Structural Alpha

Achieved through identifying structural trends which offer higher sustainable growth profile.

Unique Diversification

Small overlap with Global Equity indices allows diversified exposure to the most promising components of the equity market.

Robust & Resilient Solutions

Themes and long-term growth drivers behind performance are irrespective of economic conditions and events, and bring sense and meaning to investments.

Discover Our Funds

CPR Invest Climate Action

Investing in international equities committed to limiting impact of climate change.

CPR Invest Global Disruptive Opportunities

Investing in shares of companies which either establish or benefit – fully or partly – from disruptive business models.

CPR Invest Education

Investing in equities of companies whose activity contributes to the education ecosystem.

CPR Invest Food For Generations

Investing in international equities involved in the entire food value chain.

CPR Invest Global Silver Age

Taking advantage of the dynamics of international securities associated with the ageing of the population.

| We are committed, while designing our thematic strategies, to avoid passing fads. |

| Vafa Ahmadi, Head of Thematic Equities, CPR AM |

About CPR AM

CPR Asset Management is an innovative boutique and thematic centre of expertise for the Amundi GroupInnovation lies at the heart of CPR AM’s approach. Created in 1989, CPR AM leverages its wide range of investment capabilities (quantitative and thematic equities, asset allocation, fixed income and credit) to offer nimble, performance-driven and scalable investment solutions. CPR AM’s teams have an average of 15 years’ investment experience with proven investment capabilities. They implement disciplined and efficient investment processes that take into account risk considerations on a permanent and integrated basis. By end June 2023, CPR AM had more than €58bn assets under management. |

|

Our Approach

Our unique and innovative approach consists of favouring themes where the fundamentals are not only about one sector. A broad definition of the investment universe is good for diversification and lowers sector risk. Fueled by our managers’ convictions, portfolio construction is able to adapt to economic cycles and market regimes.

This advertisement or publication has not been reviewed by the Monetary Authority of Singapore.

Amundi Singapore Limited Company Registration No.: 198900774E