Engagement for all investors

Amundi pools the best of the Group’s capabilities to advise and work alongside asset owners in their “responsible” approach.

Our investor partners can benefit from:

Reflecting the continuous dialogue between Amundi and companies, our engagement for influence aims to support companies in taking into account environmental, social and governance (ESG) issues on specific themes.

Since 2019 and in particular in 2020, Amundi has been focusing its voting and engagement efforts on two priority themes: the energy transition and social cohesion. Both topics represent systemic risks for companies as well as opportunities for those who wish to integrate them in a positive way.

Amundi’s engagement process relies on a multi-faced approach:

- ongoing engagement on specific challenges or sustainability risks faced by an issuer or a sector,

- thematic engagement comprising of to cross-sectorial engagement on key topics such as climate or the living wage,

- collaborative engagement favoring collective efforts to encourage issuers to act collectively on key sustainable issues.

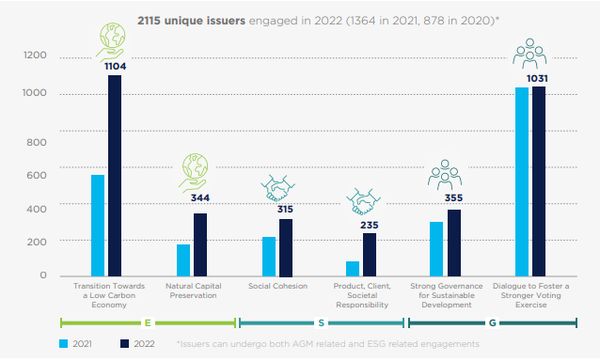

In 2022, Amundi engaged with issuers on 6 main areas, 2115 issues were raised.

Environment

- Transition towards a low carbon economy

- Natural capital preservation

Social

- Social cohesion through the protection of direct and indirect employees and Promotion of human rights

- Client, Product and Social Responsibility

Governance

- Governance practices for Sustainable Development

- Dialogues to foster a stronger voting exercice and a stronger corporate governance

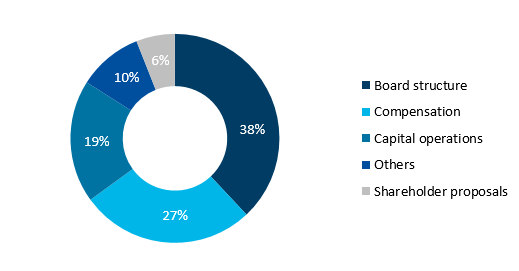

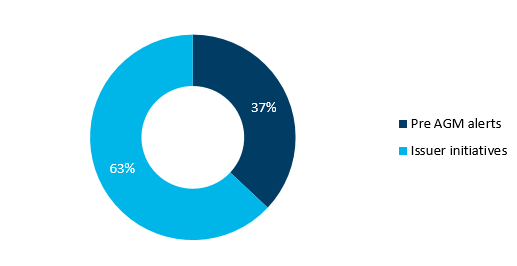

Engagement broken down by topic1

1 Source: Stewardship Report 2022

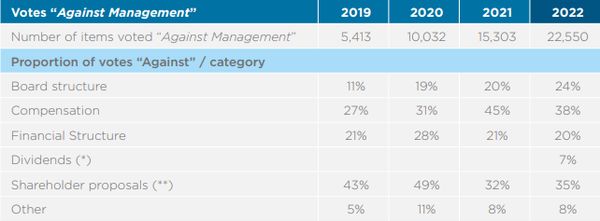

(*) A new “Dividends” category was created in 2022. These proposals were previously recorded in the “Other” category.

(**) Does not include votes for which there was no management recommendation Source: Amundi Asset Management

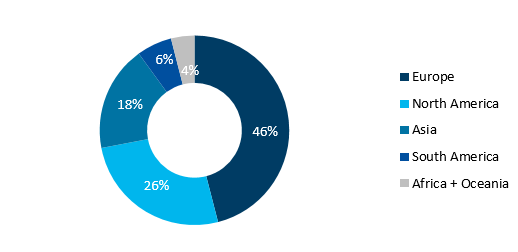

In 2022 Amundi participated to 10,208 General Meeting and voted on 107,297 Resolutions.

69%General meetings at which we voted against at least one resolution |

21%Votes against resolutions |

Thematic breakdown of votes "against management"2

2 Source : Rapport d’Engagement 2022

Amundi’s leadership has been recognized by ShareAction’s “ Voting matters 2023 ” report, according to which Amundi ranks among the top 3 asset managers in terms of voting performance on environmental and social issues (up from 10th last year).

01| Engagement for influence: accompanying issuers to better practices

Reflecting the continuous dialogue between Amundi and companies, our engagement for influence aims to support companies in taking into account environmental, social and governance (ESG) issues on specific themes, which are often controversial or subjected to a strong legislative momentum.

Since 2013, our team of ESG analysts has been particularly active on 6 themes:

- Respect for human rights in the oil and mining sectors

- The fight against food waste in the agri-food and retail sectors

- The responsible exercise of influencing practices of pharmaceutical companies and the automotive industry

- Conflict minerals

- The environmental impact of coal in the electricity generation sector

- Child labor in the cocoa and tobacco industry

- These works are subject to an engagement report published annually by the ESG Analysis and Corporate Governance team.

An active support to collective initiatives

Supporting collective initiatives is also a way to spread ESG best practices. Amundi actively supports more than twenty initiatives, including the PRI (Principles for Responsible Investment), Finance for Tomorrow, the Institutional Investors Group on Climate Change, the CDP (Carbon Disclosure Project) and the Green Bond Principles.

|

|

|

|

|

|

02 | Vote and shareholder dialogue: fully playing our role as an involved shareholderFor Amundi, the financial performance of companies can only be sustainable in a long-term vision. It is through this framework of analysis that Amundi fully plays its role as a shareholder, particularly in the exercise of its voting rights and shareholder dialogue. |

Learn more

Responsible Investing: our commitment

Acting as a responsible financial institution is a core commitment of Amundi’s development strategy.

ESG: Amundi’s 3-year action plan

An ambitious action plan to strengthen responsible investment.

Responsible investment offering

A wide range of responsible solutions from open-ended funds to tailor-made Responsible Investment.

Environment initiatives

Bring the fight against climate change accessible to all investors.

Social Initiatives

Social impact innovative solutions reaching financial performance objectives.

This report is prepared by Amundi Singapore Limited (Company Registration No. 198900774E). While reasonable care has been taken to ensure that the information contained herein is not untrue or misleading at the time of publication, Amundi Singapore Limited makes no representation as to its accuracy or completeness. Opinions expressed in this report are subject to change without notice, and no part of this report is to be construed as an offer, or solicitation of an offer to buy or sell any securities or financial instruments whether referred therein or otherwise. We do not accept liability whatsoever whether direct or indirect that may arise from the use of information contained in this report. Amundi Singapore Limited, its associates, directors, connected parties and/or employees may from time to time have interests and or underwriting commitments in the securities mentioned in this report. Past performance is not necessarily indicative of the future results. All investments carry certain elements of risk and accordingly the amount received from such investments may be less than the original invested amount. This document is not intended for citizens or residents of the United States of America or to any «U.S. Person», as this term is defined in SEC Regulation S under the U.S. Securities Act of 1933. The information contained in this document is deemed accurate as at 25 January 2019. This advertisement report has not been reviewed by the Monetary Authority of Singapore. All trademarks and logos used for illustrative purposes are the property of their respective owners.